Calendar Spread Calculator

Calendar Spread Calculator - Find high and low volatilty options for qqq and. Be sure to include an extra blank row (horizontal) and. Print a 10x10 grid or set one up virtually using one of the many free sites out there. Web in that case, a put calendar spread could be entered by selling a $50 put option and purchasing a $50 put option with a later expiration date. Following this decline in implied. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at. Web the calendar put spread calculator can be used to chart theoretical profit and loss (p&l) for a calendar put position. Web follow these simple steps: Web the negative impact of a decline in volatility on the profit potential for our example calendar spread trade appears in figure 3. They can provide a lot of flexibility and variation to your portfolio.

Print a 10x10 grid or set one up virtually using one of the many free sites out there. Web calendar spread calculator shows projected profit and loss over time. The max profit for a bull call spread can be calculated as follows: You can get started for free to get the latest data. Web the negative impact of a decline in volatility on the profit potential for our example calendar spread trade appears in figure 3. Web calendar spread calculator is used to see the projected profit and loss over time. We can then calculate the cost to close to trade.

Web updated february 13, 2021 reviewed by gordon scott investopedia / ellen lindner what is a calendar spread? Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at. Web strategy & education using calendar trading and spread option strategies by jeff kohler updated december 24, 2023 reviewed by gordon scott fact checked by. Web the negative impact of a decline in volatility on the profit potential for our example calendar spread trade appears in figure 3. Web in that case, a put calendar spread could be entered by selling a $50 put option and purchasing a $50 put option with a later expiration date.

Calendar Spreads 101 Everything You Need To Know

Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at. Web april 27, 2020 • views calendar spreads are a fantastic option trade as you’re about to find out. A calendar spread is an options or futures strategy established. Print a 10x10 grid or.

कैलेंडर कॉल स्प्रेड ट्रेडिंग कैसे करते है? जानिये हिंदी में

A calendar spread is an options or futures strategy established. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at. Web calendar spread calculator shows projected profit and loss over time. A calendar spread involves buying long term call options and writing call options.

Option Calendar Spreads

Use the optionscout profit calculator to visualize your trading idea for the long call calendar. Be sure to include an extra blank row (horizontal) and. Web strategy & education using calendar trading and spread option strategies by jeff kohler updated december 24, 2023 reviewed by gordon scott fact checked by. Web calendar spread calculator is used to see the projected.

Calendar Spread OptionBoxer

Web anytime you adjust a position, or roll a position to a new expiration cycle, it can be extremely confusing on how to figure out your profit or loss. We can then calculate the cost to close to trade. Calculate potential profit, max loss,. Be sure to include an extra blank row (horizontal) and. You can get started for free.

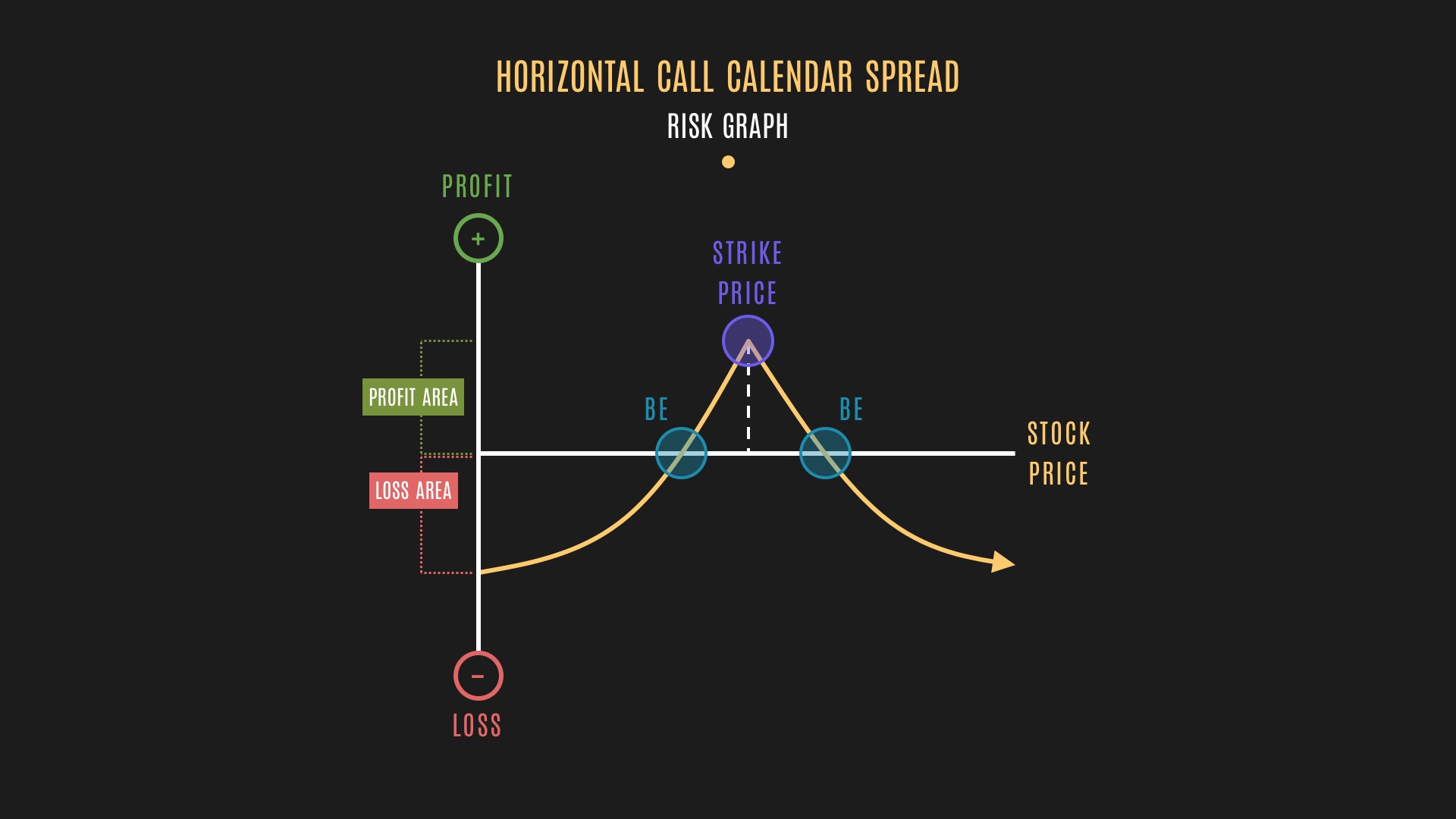

Glossary Definition Horizontal Call Calendar Spread Tackle Trading

Web strategy & education using calendar trading and spread option strategies by jeff kohler updated december 24, 2023 reviewed by gordon scott fact checked by. Web long put calendar spread calculator & visualizer. You can get started for free to get the latest data. A calendar spread involves buying long term call options and writing call options at the same.

Calendar Spread Option Calculator 2024 Calendar 2024 All Holidays

A calendar spread involves buying long term call options and writing call options at the same strike price. Web follow these simple steps: Use the optionscout profit calculator to visualize your trading idea for the long call calendar. Web updated february 13, 2021 reviewed by gordon scott investopedia / ellen lindner what is a calendar spread? Print a 10x10 grid.

Calendar Spreads Varsity by Zerodha

Web calendar spread calculator is used to see the projected profit and loss over time. Use the optionscout profit calculator to visualize your trading idea for the long call calendar. Web anytime you adjust a position, or roll a position to a new expiration cycle, it can be extremely confusing on how to figure out your profit or loss. We.

Calendar Call Spread Calculator

Data is delayed from january 16, 2024. Print a 10x10 grid or set one up virtually using one of the many free sites out there. A calendar spread involves buying long term call options and writing call options at the same strike price. Be sure to include an extra blank row (horizontal) and. Web the fantastic options spread calculator explores.

27+ calendar spread calculator AlveyAlfaigh

Calendar spread calculator shows projected profit and loss over time. Web april 27, 2020 • views calendar spreads are a fantastic option trade as you’re about to find out. Web to calculate our total return on the calendar spread, we must first compute the cost to open the trade. Web calendar spread calculator is used to see the projected profit.

Calendar Spread Calculator - Web to calculate our total return on the calendar spread, we must first compute the cost to open the trade. Web equity estimated returns select option contracts to view profit estimates. Click the calculate button above to see estimates. Use the optionscout profit calculator to visualize your trading idea for the long call calendar. Web in that case, a put calendar spread could be entered by selling a $50 put option and purchasing a $50 put option with a later expiration date. Be sure to include an extra blank row (horizontal) and. Web if you start with zero and put away $135 a month (about $33.75 a week) in a savings account that compounds monthly and earns a 4% annual interest rate, you. Clicking on the chart icon on the calendar put spread. Data is delayed from january 16, 2024. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at.

Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at. Web equity estimated returns select option contracts to view profit estimates. Web to calculate our total return on the calendar spread, we must first compute the cost to open the trade. A calendar spread is an options or futures strategy established. Web calendar spread calculator is used to see the projected profit and loss over time.

Web if you start with zero and put away $135 a month (about $33.75 a week) in a savings account that compounds monthly and earns a 4% annual interest rate, you. A calendar spread involves buying long term call options and writing call options at the same strike price. Web april 27, 2020 • views calendar spreads are a fantastic option trade as you’re about to find out. Calendar spread calculator shows projected profit and loss over time.

A Calendar Spread Is An Options Or Futures Strategy Established.

Web in that case, a put calendar spread could be entered by selling a $50 put option and purchasing a $50 put option with a later expiration date. Web the negative impact of a decline in volatility on the profit potential for our example calendar spread trade appears in figure 3. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at. Web calendar spread calculator is used to see the projected profit and loss over time.

Web April 27, 2020 • Views Calendar Spreads Are A Fantastic Option Trade As You’re About To Find Out.

Use the optionscout profit calculator to visualize your trading idea for the long call calendar. Clicking on the chart icon on the calendar put spread. Web if you start with zero and put away $135 a month (about $33.75 a week) in a savings account that compounds monthly and earns a 4% annual interest rate, you. We can then calculate the cost to close to trade.

Web Updated February 13, 2021 Reviewed By Gordon Scott Investopedia / Ellen Lindner What Is A Calendar Spread?

Web equity estimated returns select option contracts to view profit estimates. Web to calculate our total return on the calendar spread, we must first compute the cost to open the trade. Web long put calendar spread calculator & visualizer. Web follow these simple steps:

You Can Get Started For Free To Get The Latest Data.

Options strategies labeled as calendar spreads, simply mean you are execute a spread, but with contracts at the same strike. Web the fantastic options spread calculator explores the four vertical spread options strategies that provide limited risk and precise profit potential. They can provide a lot of flexibility and variation to your portfolio. Web calendar spread calculator shows projected profit and loss over time.